Track Record

Quarter by Quarter details on all closed out Trades

Most Recent Results (Current Quarter):

3/16- Sold 1/2 YIN for 15-22% Gains on 10% Position Size

3/16- Sold NUGT for 8-10% Gains on 5% Position Size

3/2- Sold UBNT for 2% Loss

3/2- Sold WLL for 3% Loss

2/28- Sold Final 1/2 FAS ETF for 6% Gains

2/24- Sold 1/2 FAS ETF for 6% gains

2/22- Sold Final 1/2 MOMO for 17% Gains

2/15- Sold Final 1/2 TDOC for 6% Gains

2/15- Sold Final 1/2 IDCC for 6% Gains

2/14- Sold AMAT for 6% Gains on 10% Position Size

2/14- Sold TRN for Break Even on 10% Position Size

2/13- Sold 1/2 TDOC For 8-11% Gains on 10% Position Size

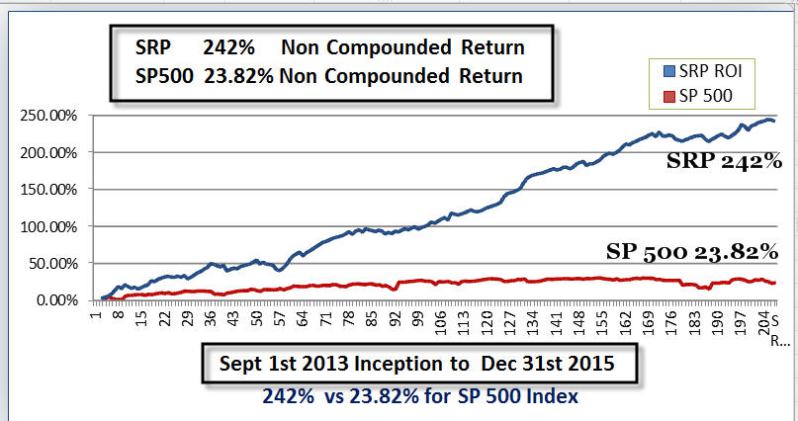

This page highlights each of the last several quarters of Closed out swing trades at SRP. We have outperformed the SP 500 Index well over 12 to 1 since 9/1/13 inception:

In 2016 we had 81 winning closed out Swing Trades and 24 Losers. A 77% success rate which is nearly unprecedented. More importantly we kept our losses contained in most cases when we were wrong and some of our winners were significant gainers.

We perform a thorough fundamental analysis on every stock we consider for a swing trade, and then if that passes our tests we then examine the technical patterns. The key to our success is maintaining this discipline in all market conditions. We also make sure to exit our positions without emotions involved, usually by selling 1/2 of the position on the way up and riding 1/2 a bit longer. We also set stops that are near the close of the market, and not intra-day which prevents us from needless losses due to normal volatility. The stops are strategically set based on behavioral patterns we apply to each trade, including 3x ETFs.

poshed at 20:19h

in

Track Record

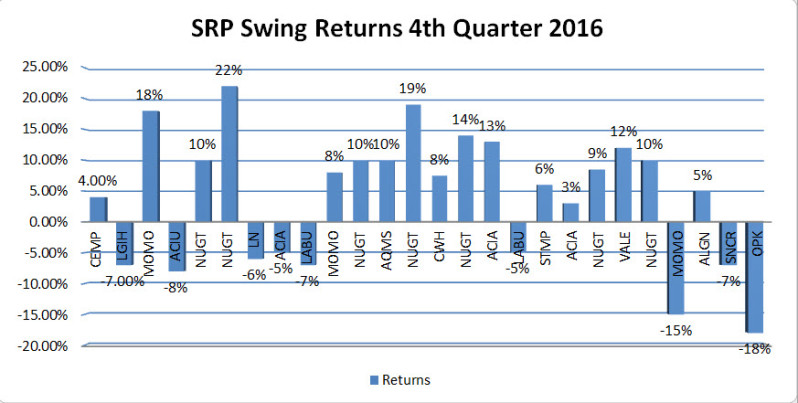

SRP 4th quarter 2016 Swing Returns Track Record

Below are the Full Details of our 4th quarter 2016 Swing Trade Track Record.

This is our entire list of closed out Swing Trades for the 4th quarter 2016.

We assume for math purposes that $20,000 is a sample size for...

poshed at 19:58h

in

Track Record

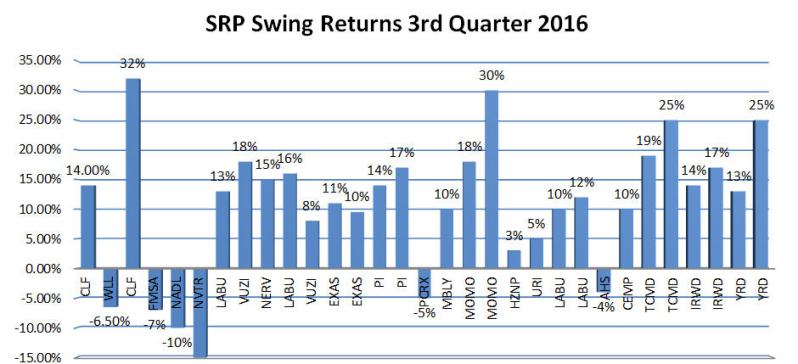

SRP 3rd quarter 2016 Swing Returns Track Record

Below are the Full Details of our 3rd quarter 2016 Swing Trade Track Record.

This is our entire list of closed out Swing Trades for the 3rd quarter 2016.

We assume for math purposes that $20,000 is a sample size for...

poshed at 20:22h

in

Track Record

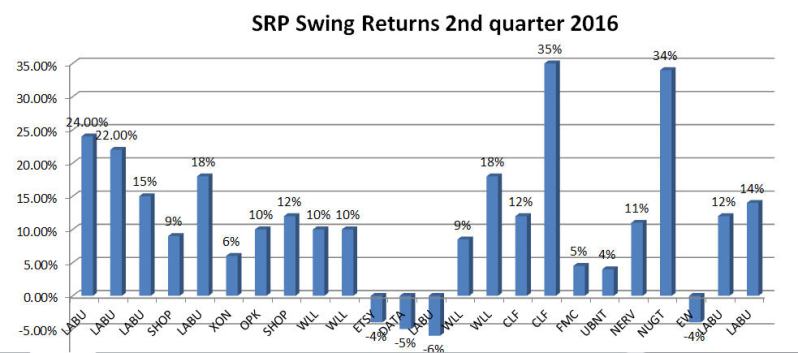

2nd Quarter 2016 Swing Returns

This is our entire list of closed out Swing Trades for the 2nd quarter 2016.

We assume for math purposes that $20,000 is a sample size for “Full Position” which we use as 10% of our model portfolio. A 1/2 position is 5%...

poshed at 20:24h

in

Track Record

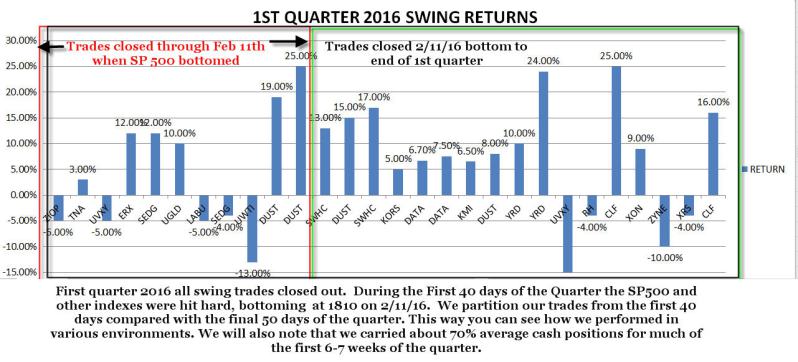

1st quarter 2016 Swing Returns

This page includes every closed out Swing Trade from the first quarter of 2016.

Many are aware the market was under extreme pressure from January 1st until February 11th 2016 when the SP 500 bottomed at 1810. The market managed to rally to...

poshed at 20:27h

in

Track Record

As of December 31st 2015 242% vs 23.82% for SP 500

This is based on 208 CLOSED Positions, open positions are not included until closed out.

We launched on September 1st 2013, we have beat the SP 500 over 10 to 1 since that inception date...